1985-2025

40 years Excellence at your Service

Global Brokerage & Wealth Management

Open Architecture & Financial Boutique Services

Περισσότερα

Wealth Management

Περισσότερα

Global Trading Facilities

Περισσότερα

Corporate Finance

Περισσότερα

ESG Services

Περισσότερα

Our History

1985 – 2025

1985 – 1988

Beginning of Wealth Managemewnt activities in Switzerland with Banque Worms

through Europlacements Inc.,

predecessor of Eurocorp

1985

1988 – 1991

Establisment of Eurocorp in Greece as representative of Banque Worms

Deeply involved in the privatization process in Greece

Achievement of the first privatization

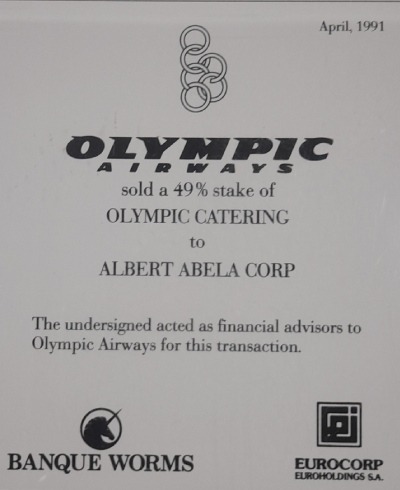

Advisor to

Olympic Airways for the privatization of Olympic Catering

1991

The Investment and Financial Advisory Firm EUROCORP acted on behalf of the buyers for the execution of the above transaction.

1990

The Investment and Financial Advisory Firm EUROCORP acted as the financial advisor in the above transaction.

1989

Advisor for the share capital increase of Vernicos Yachts by 300,000,000 drachmas through private placement.

1991

1992 – 1993

Establishment of Aeolian Fund as the group’s closed end fund

and its listing in the Athens Stock Exchange

Establisment of Aeolian Fund & listing in the Athens Stock Exchange

1992

The National Bank of Greece sold a majority stake in Aspioti-ELKA S.A. to J.J. Lesueur. Eurocorp acted as financial advisor.

1992

Ideal Standard Spa acquired 100% of the shares of Ideal Standard ABE. Eurocorp acted as financial advisor.

1992

Rilkens’ share capital increase of 216,598,200 drachmas and transfer to the Main Market of the Athens Stock Exchange. Eurocorp acted as issuing advisor. Commercial Bank of Greece acted as underwriter.

1993

1994 – 1995

Minority participation in the securities company, Avax, optimization of synergies

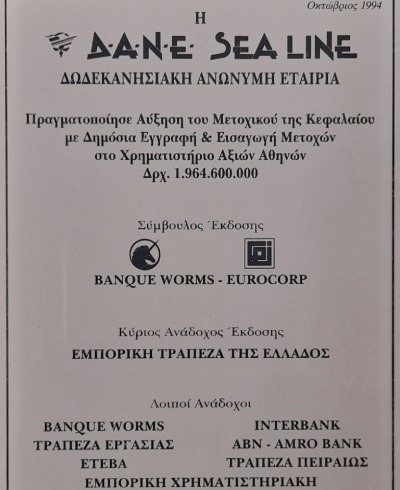

DANE Sea Line

IPO Advisor

1994

Advisor to

Tractebel for the acquisition of Asprofos

1994

GNOMON-EMPEDOS

Construction Co

IPO Advisor

1994

REMEK Pharmaceuticals

IPO Advisor

1995

1996 – 1997

Activities and involvement in the IPO’s of maritime and construction sectors

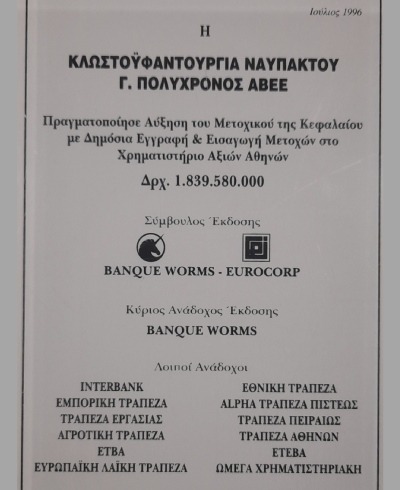

Nafpaktos Textiles

IPO Advisor

1996

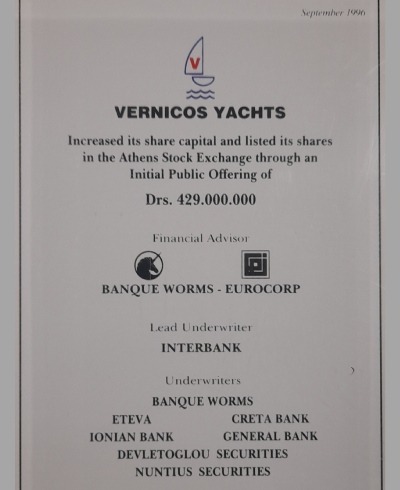

Vernikos Yachts

IPO Adrivisor

1996

Hellenic Telecommunications Organization

IPO Underwriter

1996

CLUB MED

Advisory Services

1997

1998 – 2001

Participation in the development of Greek Capital Markets

and realization of various privatizations

Hellenic Petroleum

IPO Underwriter

1998

Cronus Airlines

Advisor for the acquisition

by Laskarides Group

1999

HYATT

IPO Underwriter

1999

NEL LINES

Private Placement to

Institutional Investors

1999

Advisor to

the Greek State

for the privatization of

ELVO

2000

IDEAL Group

IPO Underwriter

2000

OPAP

IPO Underwriter

€ 175 m

2001

2002 – 2003

Eurocorp integrates Credit Lyonnais

& cooperates with Credit Lyonnais Securities,

Credit Lyonnais Asset Management & Clinvest

Public Power Corp.

Third Tranche

Underwriter

€ 308 m

2003

Intramet/Intrakat

IPO Underwriter

2003

OPAP

Third tranche

Underwriter

€ 736 m

2003

Port of Piraeus

IPO Underwriter

€ 57 m

2003

2004 – 2006

Integration into Calyon Bank

and business development with Chevreux Securities

ARVAL

Advisory services to Arval

for the acquisition

of Dirent

2004

OPAP

Fourth tranche

Underwriter

€ 1,266m

2005

Advisor to

ALCAN

for the sale of

Aluminium of Greece

to MYTILINEOS GROUP

2005

Elinoil

IPO Underwriter

2005

Advisor to the

Imprimerie Nationale

for the Chronotachygraphe mandate

of the Republic of Cyprus

2006

2007 – 2009

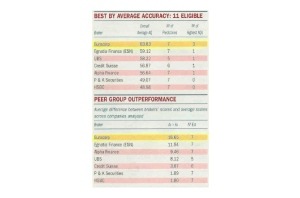

Eurocorp Equity Analysis team awarded 1er in the world for Greek securities

Eurocorp BMP

Delisting Advisor

to Gregory’s S.A.

2009

2010 – 2011

Withdrawal of Credit Agricole from Greece

Desinvesting from Eurocorp and Emporiki Bank

2012 – 2014

Association with Global Investment Services Paris

and establishment of Eurocorp France

Valuation advisory to

Dias Aquaculture S.A.

for public offering

2012

Advisor for

Capital increase

€ 75 m

2013

2015 – 2016

Colbert Participation became the new shareholder

Reorientation towards Wealth Management activities

Acquisition of Stratege Finance Paris

2017 – 2018

Launching in Paris of Eolos Fund for Greek Securities

and in Athens Phoenix Greek Equities Fund

Eolos

Launcihng of

Eolos French Fund

for Greek Securities

2017

Phoenix

Launching of

Phoenix Greek Equities Fund

2018

2019 – 2022

Participation in various corporate finance transactions

as advisor to CMA-CGM, Allianz, Reggeborgh, Bagatelle

Advisor for

the Debt Restructuring

of

ASTIR Hotel Patras

2020

Advisor for

Bagatelle Mykonos

financing

2021

Valuation Advisory to

Allianz

for the acquision of

European Reliance

and the tender offer

2021

2023 – 2025

Pursuit of excellence in the Wealth Management and Corporate Finance

Valuation Advisor

to Reggeborgh

for the tender offer

2022

Advisor for

the concession

& the renovation

of Astir Hotel

2023

Valuation Advisory

to the shareholders

2024

Advisory for the sale of

ΤΑΧΥΤΥΠΟ &

PRESS PACK

to

NIKI GROUP

2024